Overtime tax rate calculator

Ohio has a progressive income tax system with six tax brackets. Taxable income Annual gross salary - Pension Provident RAF limited to 275 of salary limited to R350k - 20 of travel allowance You.

Paycheck Calculator Take Home Pay Calculator

If you make 1800 per hour your overtime rate is 2700 per hour.

. For all filers the lowest bracket applies to income up to 25000 and the highest bracket only. SmartAssets Texas paycheck calculator shows your hourly and salary income after federal state and local taxes. In case someone works in a week a number of 40 regular hours at a pay rate of 10hour plus an 15 overtime hours paid as double time the following figures will result.

Withhold 62 of each employees taxable wages until they earn gross pay of 147000 in a given calendar year. Overtime tax calculator Using an internet overtime tax calculator can make calculating tax easy but you can also work out the number for yourself. When an employer pays overtime to any employee that is not more than 50 of the employees monthly basic salary the employer will deduct 5 as overtime tax.

The simplest way to work out how much. If you are paid a salary based on a 40-hour workweek your regular rate is determined as follows. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

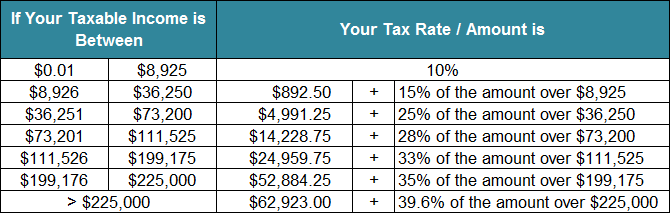

The lowest tax bracket or the lowest income level is 0 to 9950. If you do any overtime enter the number of hours you do each month and the rate you get paid. Thats where our paycheck calculator.

Overtime Hours per pay period Dismiss. However if the overtime. Overtime Hours per pay period.

This is how you work it out. 10 x 40 hours 400 base pay 10 x 15 15 overtime rate of pay 15 x 6 overtime hours 90. Overtime Hourly Wage.

How Is Overtime Pay Calculated In South Africa. It is taxed at 10 which means the first 9950 of the money you made that year is taxed at 10. Depending on the week employees.

In the Weekly hours field enter the number of hours you do each week excluding any overtime. Rates range from 0 to 399. You cant withhold more than your.

As long as the employee remained in the original tax brackets the rate of income tax was the same. Multiply your monthly salary. This workers total pay due including the overtime premium can be calculated as follows.

The next six levels are taxed. If you do any overtime enter the number of hours you do each month and the rate you get paid at - for example if you did 10 extra hours each month at time-and-a-half you would enter 10. The maximum an employee will pay in 2022 is 911400.

Federal income tax rates range from 10 up to a top marginal rate of 37. The overtime calculator uses the following formulae.

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Free California Payroll Calculator 2022 Ca Tax Rates Onpay

Overtime Pay Calculators

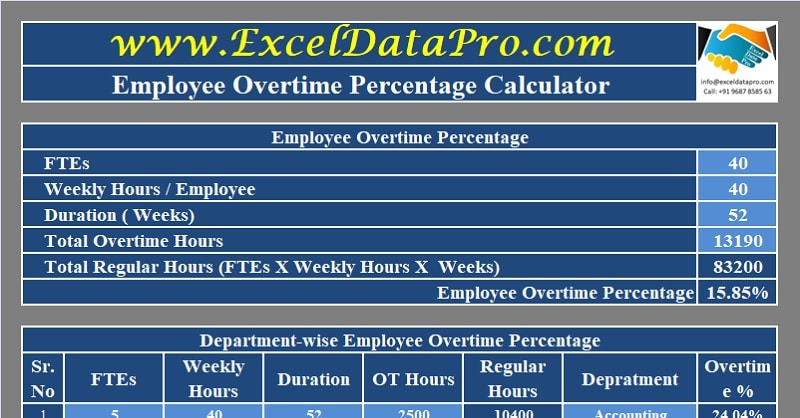

Download Overtime Percentage Calculator Excel Template Exceldatapro

Salary Pay Tax Calculator Suburbsfinder

The Certified Payroll Professional Corner Regular Rate Calculation For Overtime Purposes

Overtime Pay Calculators

Why Is Overtime Taxed At A Higher Rate How Are The Rates Determined Quora

Solved W2 Box 1 Not Calculating Correctly

How To Calculate Payroll Everything Employers Need To Know

2022 Federal State Payroll Tax Rates For Employers

Paycheck Calculator Take Home Pay Calculator

Federal Calculator Calculator Federal Credit Union Hadleysocimi Com

Esmart Paycheck Calculator Free Payroll Tax Calculator 2022

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Overtime Calculator

Overtime Calculator How To Calculate Time And A Half